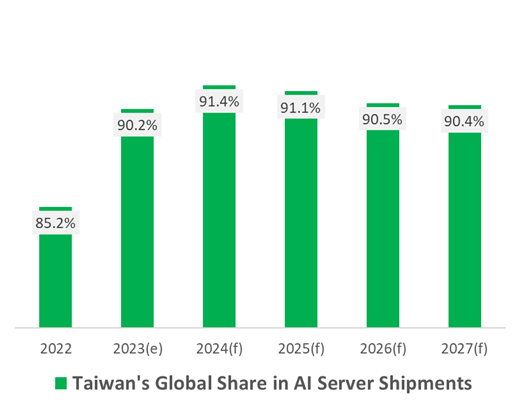

The Market Intelligence & Consulting Institute (MIC) of the Institute for Information Industry (III) reported that the ongoing surge in Generative AI will likely continue to propel the growth of global AI server shipments this year. In 2023, the output value of AI servers reached more than half of the total global server production. Taiwan, already responsible for over 80% of global server shipments, holds a commanding 90% share in the production and assembly of AI servers. This is primarily attributed to Taiwan's advanced capabilities in the design, development, and assembly of high-end servers, coupled with restrictions on high-end chip exports to China and the preference of U.S.-based clients for production outside China. MIC's Industry consultant Chris Wei remarked that the wave of Generative AI applications and the boom in AI server shipments are beneficial for revenue growth among Taiwanese server original equipment manufacturers (OEMs), power supply providers, remote control chipmakers, Ajinomoto Build-up Film (ABF) substrate board producers, heat module suppliers, and other industry chain participants.

As the global AI server market continues its robust growth, its share in overall server shipments is expected to increase from 12.4% in 2023 to 20.9% in 2027. According to MIC's projections, the global AI server shipments are estimated to reach 1.942 million units in 2024, further to 2.364 million units and 3.206 million units in 2025 and 2027, respectively. The compound annual growth rate (CAGR) is expected to grow to 24.7% from 2022 to 2027. This includes high-priced AI training servers employing advanced graphic process units (GPUs), as well as AI inference servers using mid-to-low-range GPUs, Field Programmable Gate Arrays (FPGAs), and Application-specific integrated circuit (ASICs).

Looking ahead to 2024, MIC anticipates two major growth drivers for AI servers: the cloud training fields for Large Language Models (LLMs) and the emerging arena of "small and medium-sized language models." Major cloud service providers are actively expanding their LLM and Generative AI applications, with Google set to launch Gemini this year and Amazon actively training new LLMs. Additionally, the forecasted emergence of small and medium-sized language models is expected to be a new competitive area in 2024, with custom and operationally efficient models such as Llama-2, Microsoft Phi-2, Google Gemini Nano 2, among others. Chris added that the significant procurement of high-end AI servers by various companies, enhancing their AI computational capabilities in data centers, along with the continued adoption of AI computational power by government entities in defense, research, and other sectors, underscores the pivotal role of AI servers as a crucial indicator of a country's digital readiness in the digital era.

Taiwan's Global Share in AI Server Shipments, 2022-2027

Source: MIC, January 2024

About Market Intelligence & Consulting Institute (MIC):

Established in 1987, Market Intelligence & Consulting Institute (MIC) is a division of III (Institute for Information Industry), a major government think tank, and one of the leading IT research institutes in Taiwan. MIC specializes in industry and market research. With over three decades of experience, MIC provides valuable insights and data-driven recommendations to assist businesses in making informed decisions.

To know more about this topic, please visit: Global Server Market Forecast, 2023-2027, Development of the Server Industry and Market, 2023 and Beyond (pre-order), Stay Ahead: 2023 Semiconductor Industry Research Value Pack

For future receipt of press releases, please subscribe here

To know more about MIC research findings, please access our website.

For future inquiry, please contact MIC Public Relations

If you prefer not to receive notifications, please click here to unsubscribe